Lloyds Bank has introduced the new service as more than 2.2 million customers have signed up to new subscription services since the Covid-19 lockdown

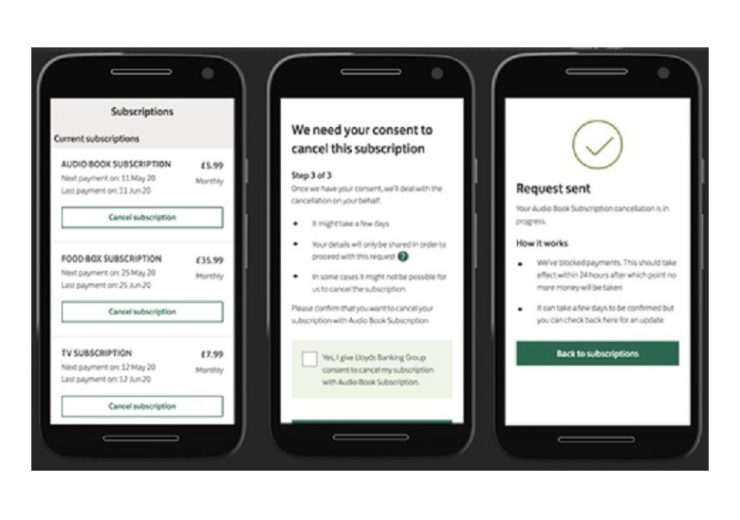

Screenshot of the new subscription management service. (Credit: Lloyds Bank plc.)

UK banking giant Lloyds Bank has introduced new subscription management service to its mobile banking app, enabling customers to view, manage and/or amend subscription services.

The bank has partnered with Swedish fintech Minna Technologies and Visa to provide the service.

The development follows as the bank now has more than 2.2 million customers signed up for new subscription services since the Covid-19 lockdown started.

The bank saw over 1.3 million of its customers adding new subscriptions in March, quadrupling from 325,000 in February.

The new service will help customers to manage their monthly subscription services including TV and film streaming providers, audio book services and food boxes, with ease and convenience.

With the new feature at hand that is simple, easy to use and free of charge, customers can keep track of their spending as they will be provided with a snapshot of debit card subscriptions.

In addition, real time push notifications will be sent to customers to keep them informed about subscription charges including price increases. They can also cancel subscription for a service or a product that they do not want to use from within the app.

The service, which is in pilot stage, will soon be available across the UK

Lloyds Bank digital service director Nick Edwards said: “Customers have been able to manage direct debits and standing orders online for some time. With the growing popularity of subscription services we’ve launched this market leading service to respond to our customers’ desire for more control and flexibility in the ways they manage their money.

“With over 16 million customers online and 12 million using our mobile app, this is one in a series of new and exciting features we are launching this year to continually improve customers online experience.”

The new service is presently in pilot stage and will soon be available for customers across the UK, the bank said.